HB1110 – Creates a low carbon fuel standard.

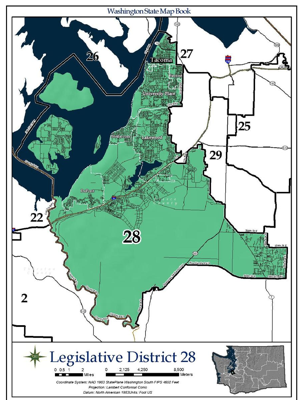

Prime Sponsor – Representative Fitzgibbon (D, 34th District, Vashon Island & West Seattle)

Current status – Returned to House Rules, 3rd Reading by Senate at end of 2019 Session; reintroduced and retained in present status for 2020 session. Passed the House January 30th. Referred to the Senate Committee on Environment, Energy and Technology. Replaced with a striker and passed out of committee February 25th. Referred to the Transportation Committee and had a hearing there March 2nd.

Next step would be – Action by the committee.

Legislative tracking page for the bill.

SB5412 is the identical companion bill in the Senate.

House Bill Analysis

*********

2019 history –

In the House (Passed)-

2019 Session History – Amended in minor ways and reported out of the House Environment and Energy Committee as SHB1110, January 24th. Passed out of the Transportation Committee February 14th. Had a hearing in the House Committee on Appropriations February 21st; a 2nd substitute version with further changes passed out of Appropriations February 25th. Referred to Rules February 28th. Passed the House with a number of amendments March 12th.

In the Senate-

Referred to the Senate Committee on Environment, Energy & Technology. Had hearing March 19th; amended by a striker and passed out of committee March 21st. Referred to Transportation Committee. Had a hearing on a proposed striker by Senator Hobbs Wednesday, April 4th. Striker was not adopted. Bill was still in committee by 2019 cutoff. Returned to House Rules, 3rd Reading by Senate at end of 2019 Session

Proposed striker in the Senate…

Senator Hobbs’s striker would have put a fee of $6/tonne of carbon on transportation fuels for 2021-2028 (with no inflation adjustment), then reset the fee by the Legislature for 2029-2035. 50% of the revenue would have gone to motor vehicles and 50% to multi-modal. There were various exemptions, a null and void clause if rule making wasn’t funded in this session’s omnibus transportation package, and a 5¢/gallon tax on the biofuel included in blended fuels.

Changes in the Senate

The changes in the Senate striker are summarized on its last page. Though the summary doesn’t mention it, the striker dropped the prohibition on giving credits to palm oil fuels, which may have been beside the point, since the bill requires the rules on emissions standards to be based on a full life-cycle analysis. including land use changes. (The striker also provided more options for how utilities can spend the half of their credits from providing electricity for transportation that aren’t required to go to transportation electrification projects. Under it, they could have used the money from these to offset increases in their own fuel costs or to invest in a wide variety of other carbon reduction projects, and could have chosen to use up to 10% of it on rate reductions for low-income households.

Changes in the House

The minor technical changes made to the original HB1110 by amendments in the House Environment & Energy Committee are summarized on pp. 7-8 of the House Bill Report. The second substitute added an exemption for some military fuel as well as provisions about renewable hydrogen, and made the entire bill null and void if it didn’t receive specific funding in the omnibus appropriations act by June 30th, 2019.

The floor amendments:

- Exempt fuels in off-road logging, mining, construction, and the dyed special fuel in agricultural operations from greenhouse gas intensity requirements until 2028, but allow them to earn credits;

- Prohibit awarding credits for fuels from palm oil;

- Require consideration of land-use changes in calculating the carbon intensity of fuels from sugar cane;

- Allow awarding of credits for a wide variety of activities that “support the reduction of greenhouse gas emissions associated with transportation” including oil carbon capture and sequestration projects, direct air capture, charging vehicles with zero emission electricity; zero emission refueling infrastructure, and smart charging technology. (Apparently, some of these credits are directly tied to how much you invest, not to demonstrating actual reductions as a result of the investments.);

- Require estimating and announcing annually the costs or cost savings per gallon of gasoline attributable to the clean fuels program; and,

- Specify that hydroelectricity, including power from incremental efficiency improvements, counts as a zero emissions fuel under the bill.

2020 History –

According to the staff summary, the striker in the Senate committee makes the program contingent on the passage of a transportation act with at least $2 billion in new funding and a plan and funding to replace the I-5 bridge over the Columbia and the US-2 trestle (which happens to be in the district of Senator Hobbs, the chair of the Senate Transportation Committee.) It delays the start of the program for a year, or until the required transportation funding is obtained. It adds a renewable fuels facility capable of producing more than 100 million gallons of renewable energy products a year to the list of projects of statewide significance that are eligible for expedited approval. It shifts the required reinvestment of 30% of utilities’ credits revenue from areas with poor air quality to “highly impacted communities”, and allows (but doesn’t explicitly require) Ecology to evaluate transportation fuels using a third-party screening protocol that assesses its associated social, environmental, or labor impacts. (It doesn’t say what the impact or consequences of the assessment are supposed to be, so the point of this provision isn’t clear…)

Summary –

Requires the Department of Ecology to create rules to reduce the greenhouse gas emissions from transportation fuels used in Washington to 10% below 2017 levels by 2028 and to 20% below 2017 levels by 2035. (Fuels for aviation, shipping, and locomotives are exempted.)

Comments –

The Puget Sound Clean Air Agency is considering adopting a Regional Clean Fuel Standard for King, Pierce, Kitsap, and Snohomish Counties. (People say it announced it would do this, but their website doesn’t say that yet.) (Presumably, this motivated Senator Hobbs to add “local agencies” to the poison pill provisions in his new transportation proposal – SB5971. (One of these altered sections starts on p. 54, line 5, if you’re interested.)

Governor Inslee’s budget proposal provides $959,000 for the Department of Ecology to implement the program (though his policy brief provided $1.4 million for it.)

Rep. Fitzgibbon’s LCFS bill, HB 2338, which passed out of the House Environment and House Transportation committees last session, would have created a standard at the same level. Carbon Wa’s testimony in support of that bill included quite a bit of useful analysis.

There’s a comparison of the bill and the California and Oregon programs here.

Climate Solutions has produced a flyer supporting the bill, and an FAQ responding to the main attacks on the bill.

Details :

Standards –

- Must be based on a full lifecycle analysis of the emissions associated with each fuel, including its production, storage, transportation, and combustion, as well as associated changes in land use.

- Must measure the emissions from electricity for each electric utility based on its mix of power sources.

- Ecology can require additional reporting from fuel distributors and utilities if it’s needed.

- The department may create additional exemptions to avoid mismatched incentives among programs, fuel shifting among markets, or other unintended consequences.

- It must decide whether or not emissions reductions under the clean fuels program will count toward meeting the requirements of the clean air rule, and vice versa.

– Credits and trading

Ecology must create a system for generating, banking, trading, and verifying credits for emissions reductions. Participation in this system is voluntary, and it’s also open to suppliers and users of aviation, shipping, and locomotive fuels who make reductions in their associated emissions. Credits may be awarded for producing, importing, or dispensing fuels for use in the state, and for other activities that reduce the emissions associated with transportation fuels. They may not be awarded for any fuels with emissions above 80% of the standard.

The bill extends the penalties for violations of the Clean Air Act to violations of this act. Ecology may charge a fee to cover the costs of the program; these and any penalties collected under the program go into a new clean fuels fund account, which can only be spent through appropriations.

– Cost containment mechanisms

These may include creating a credit clearance market to put a ceiling on prices by making credits available at a level Ecology sets, and/or some similar method to provide credits to participants who have not been able to attain them. (These mechanisms must be designed to financially discourage people from relying on them instead of reducing emissions.)

Ecology can create an entity to aggregate and use credits for emissions reductions made by parties that choose not to participate in the credit market.

– Relations with other states

Ecology should seek to adopt rules that work well with the systems in other jurisdictions that have adopted clean fuels standards (such as Oregon, California, and British Columbia), and in ones we import fuels from or export fuels to.

– Electric utility reinvestments

Half the revenue from credits earned by an electric utility must be reinvested it transportation electrification projects, and 60% of that (30% of the total) must be spent on projects in places where air pollution is bad enough so they’ve been identified as non-attainment or maintenance areas under the National Air Quality Act. Ecology may adopt requirements for the reinvestment of the other half of this revenue, in consultation with the utilities.

– Reporting

Requires an annual report about the program on Ecology’s website, and an annual report to appropriate committees of the Legislature, starting in 2022, with draft legislation for any recommended changes to achieve the program’s goals more efficiently.

Requires a fuel supply forecast by Commerce, in consultation with Ecology and the Department of Agriculture, at least 90 days in advance of each compliance period; this must include a prediction about whether sufficient credits from low carbon fuels (and banked will be available to meet the program’s requirements.

The Joint Legislative Audit Committee must report to the Legislature on the impacts, costs and benefits of the first five years of the program before the end of 2027.

– Removes “poison pill” provisions

In 2015, Republicans inserted provisions into the transportation package to transfer the state’s funds for bicycling and transit to highway projects if a clean fuel standard was created; the bill removes those.